Allstate helps provide you peace of mind with comprehensive identity theft plus cyber security protection. If a potential threat is detected, you are notified via email, text, phone or mobile app alerts. Should you become a victim of identity theft, Allstate provides a dedicated restoration specialist to help restore your identity. The plan coverage details are outlined below:

With the Allstate Pro+ Cyber coverage, some of the included services are:

Family Protection

- Protection for the whole family when enrolled in the family coverage Tier

• Senior family coverage (parents,

grandparents, and in-laws age 65+)**

• Elder Fraud Protection & Fraud Center

• Scam Support

Cyber Protection

- Personal computer security

• Antivirus protection

• Safe browsing and phishing protection

• Web filtering

• Data breach notifications - Mobile Device Security

• Mobile device and app security for 5

mobile & desktop devices - Password manager

Identity Financial Monitoring

- Rapid alerts

- Allstate Security Pro® emerging threats and scam alerts

- High-risk transaction monitoring

- Financial transaction monitoring

- Dark web monitoring for personal data and passwords

Restoration

- U.S.-based, 24/7 customer care

- Full-service remediation support

- Remediation for pre-existing conditions

- Fraud resolution tracker

- Unemployment Fraud Center

- Tap-to-call from mobile app

Privacy & Data Monitoring

- Allstate Digital Footprint℠

• Personalized online account discovery

• Privacy insights & management tools

• Data breach notifications

Credit

- Tri-bureau credit monitoring

- Credit lock (adults & minors)

- Credit report disputes

Download the Identity Theft policy document

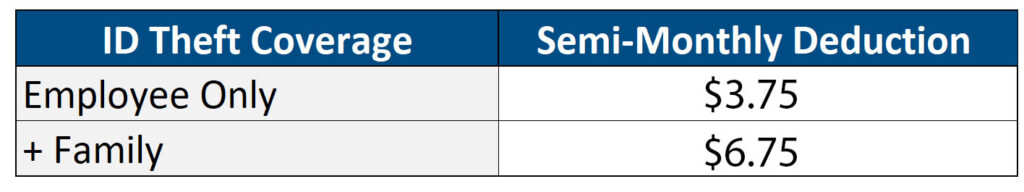

Identity Theft Premiums