Home » Benefits » Savings and Spending Accounts » 2023 Savings and Spending Accounts

2023 Savings and Spending Accounts

The Health Savings Account (HSA) and Flexible Spending Accounts (FSAs) help you save money on out-of-pocket expenses that you and your family incur during the calendar year. There are a number of different types of accounts that help to reduce your taxable income when paying for eligible expenses for yourself, your spouse and eligible dependents.

NOTE: You may only participate in the HSA bank account if you are enrolled in the Cigna HDHP plan.

Flexible Spending Accounts (FSA)

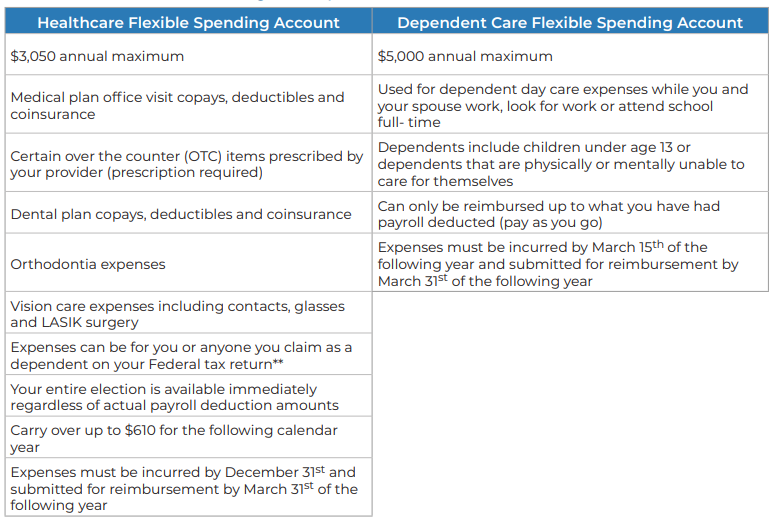

The Flexible Spending Accounts are an easy way for you to keep more of your take-home pay by using “pre-tax” dollars for eligible expenses. Simply present your FSA debit card for the purchase of eligible services and goods. Using the debit card allows you to directly tap into your Healthcare and Dependent Daycare FSA, meaning better cash flow for you and no waiting period for reimbursement

Eligible Expenses* and Guidelines

*This is only an example of eligible expenses.

**Visit irs.gov for definition of eligible tax dependent as well as a view a full list of eligible expenses under Section 125.

Health Savings Account (HSA)

The HSA is a savings account used to pay for qualified medical expenses by using your Flores HSA debit card or to reimburse yourself at any time for medical, dental or vision expenses paid out of pocket. There is no time limit to reimburse yourself and the funds must be available in the account to use them. Be sure to check your balance before making a payment or swiping your card at a provider’s office. Any unused funds rollover and all funds are yours to keep!

You can contribute to an HSA only if you are enrolled in the Cigna HDHP Plan and are not covered by any other traditional medical plan (including your spouse’s plan or Medicare) or flexible spending account.

If you enroll in the Cigna HDHP Plan and you choose to participate in the HSA, you will be required to contribute a minimum of $25 to your HSA.

In 2023, The Liberty Company will contribute up to $500 into your Flores HSA Account for individual coverage or “family” coverage, based upon your enrollment date. Family coverage for this plan is defined as any coverage other than single. If you currently have an HSA Account with another

vendor, you can choose to transfer the money to your Flores account as we will no longer be sending contributions to other vendors. Please contact your account administrator and Flores for additional details.

Maximum contributions are set by the IRS. For 2023, the total (employer & employee) maximum contribution is $3,850 for single coverage, or $7,750 for family coverage (per household). An annual catch-up amount of $1,000 is available for employees ages 55-65.

In order to contribute to an HSA, you cannot maintain a Flexible Spending Account (FSA) except for a Limited Purpose FSA, which is not offered by The Liberty Company. If at any point you change medical plans and are no longer enrolled in the Cigna HDHP Plan, you cannot continue to contribute to your HSA. However, you may still use any funds in your HSA to pay for qualified medical expenses.

The HSA is administered by Flores. You can connect to Flores at www.flores247.com or call our dedicated account manager Paulina at 800- 532-3327.

Remember your money is saved pre-tax, grows tax-free and is withdrawn tax-free. You own your HSA. Your account carries over from year to year and goes with you if you take a job with another employer.

In accordance with the USA Patriot Act, you may be asked to provide Flores with identification documentation to verify and establish your HSA.