Voluntary benefits provide an additional layer of financial protection for you and your family. These benefits will help cover any extra out-of-pocket expenses if you suffer an unexpected, serious illness or qualifying accident.

Accident Insurance

Injuries occurring off the job can be protected with Reliance Standard’s Accident Insurance. This plan is designed to pay cash directly to you. This additional cash support can be used to help pay any out-of-pocket expenses related to the injury. Payments are made tax free, to be used at your discretion.

Injuries occurring off the job can be protected with Reliance Standard’s Accident Insurance. This plan is designed to pay cash directly to you. This additional cash support can be used to help pay any out-of-pocket expenses related to the injury. Payments are made tax free, to be used at your discretion.

Accident Insurance Wellness Benefit

$50 per insured person per year for completing routine wellness screenings.

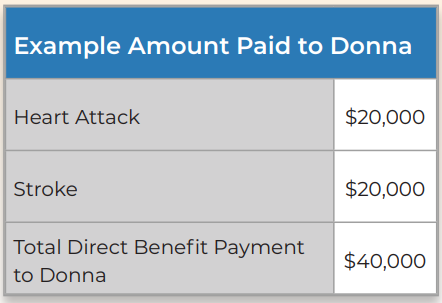

The tables below highlight some of the key benefits covered under this plan and give an example of how this plan would pay out for a broken ankle.

Critical Illness Insurance

There can be a lot of expenses incurred with a critical illness and a major medical plan may not cover them all. Critical Illness coverage with Reliance Standard pays cash directly to you upon a diagnosis.

You have the option to select the tiered coverage amount of your choice, and with no pre-existing condition limitations. Employees can elect up to $20,000 of coverage (increments of $5K) on a guaranteed issue basis. Spouse/ Domestic Partner can elect $5K, $7,500 or $10, not to exceed 50% of the employee’s amount. Child(ren) coverage is automatically included at 50% of the employee’s benefit amount, maximum of $10K. An employee must elect coverage for themselves to have coverage on dependents.

Critical Illness Wellness Benefit

$100 per insured person per year for completing routine wellness screenings.

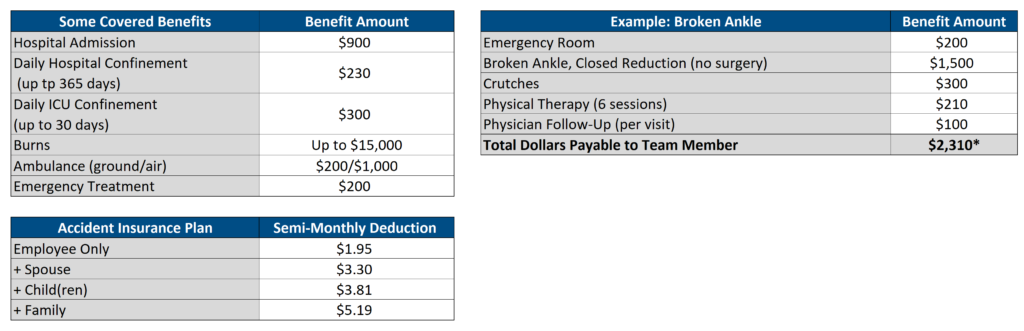

Below is an example of how the Critical Illness plan works:

Donna’s life was turned upside down when she suffered a heart attack, which was followed by a stroke only a month later. Not only did she miss work, but so did her husband to help her during her recovery. Their income took a hit and bills piled up. Donna had enrolled in Reliance Standard ’s Critical Illness plan with a $20,000 benefit amount per diagnosis. She received a total benefit payment of $40,000 in her family’s greatest time of need